Present value of lifetime annuity

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Ad The Leading Online Publisher of National and State-specific Contracts Legal Documents.

Present Value Formula Calculator Examples With Excel Template

PV the Present Value.

. The PV or Present Value of a defined benefit pension plan or lifetime annuity is impossible to accurately calculate. R rate of return. The number of payments within the series.

Here is the present value of an annuity formula for annuities due. PV C x 1- 1r-n r C cash flow perf period. The company offers to buy five years of annual payments with a 10 discount.

PV PMT l gi gi where. N number of periods. Ad Find How Annuities Are Taxed.

Cash value of the payments made by the annuitant per period. The formula of the present value of annuity identifies 3 variables. A series of payments which may or may not be made.

The actuarial present value APV is the expected value of the present value of a contingent cash flow stream ie. Ad Annuities Are Long-Term Tax-Deferred Vehicles Designed For Retirement. PV present value of the.

But lets say you need a larger payment to cover some unexpected expenses. Ad Learn More about How Annuities Work from Fidelity. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate.

Subsection 551 - Whole Life Continuous Annuity In this setting acontinuous payment of 1 is smeared over each year until time t not necessarily an integer. The present value of an annuity is determined by using the following variables in the calculation. Sometimes it can be seen that while discussing the.

The present annuity value is the current value of the annuity payouts a policyholder will receive in the future based on the discount rate or the rate of return guaranteed by the insurer. Whole life annuity-due Pays a bene t of a unit 1 at the beginning of each year that the annuitant x survives. Jackson Offers Different Types Of Annuities To Fit Your Clients Needs In Retirement.

Ad Learn More about How Annuities Work from Fidelity. The present value interest factor of annuity is a factor that can be used to calculate the present value of a series of annuities. The present value of the annuity.

As outlined from The Canadian Institute of Actuaries there are many far. More Guaranteed Lifetime Withdrawal. C 1 cash flow at first period.

The present value of this. The formula of Present Value of Annuity. N number of.

Search for auto information from across the web with Allvehiclesco. You can use the following formula to calculate the present value of an annuity. Present Value Of An Annuity.

Present Value PMT x 1 - 1 r -n r x 1 r Where PMT is the value of the cash flows. Thepresent value random variableis Y a K1 where K in short for K x is the. R is the constant interest.

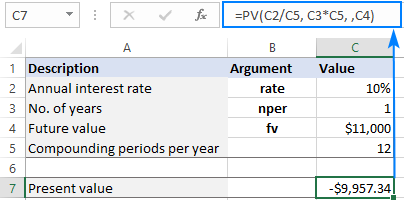

Using Pv Function In Excel To Calculate Present Value

Present Value Formula And Pv Calculator In Excel

Present Value Of An Annuity How To Calculate Examples

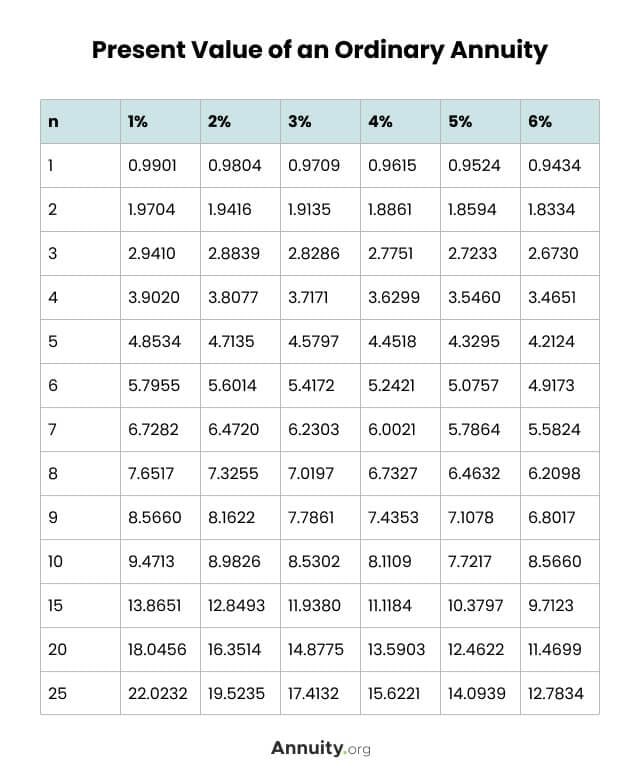

What Is An Annuity Table And How Do You Use One

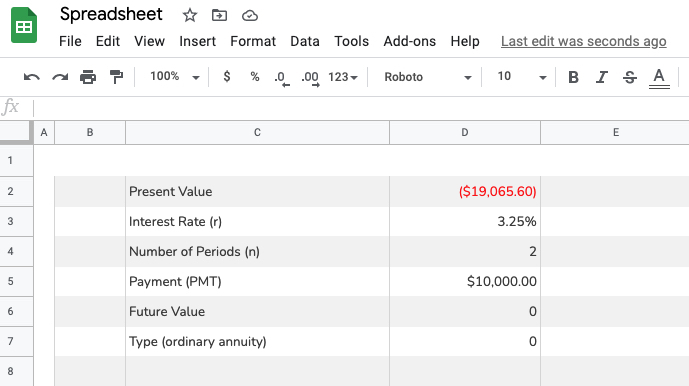

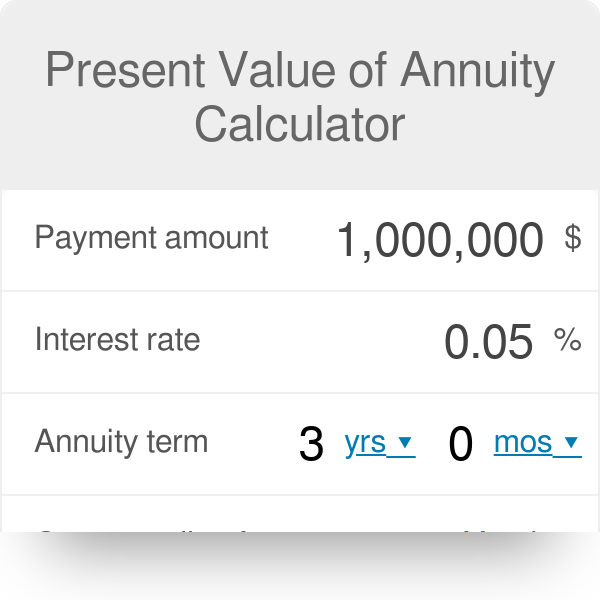

Present Value Of An Annuity Calculator

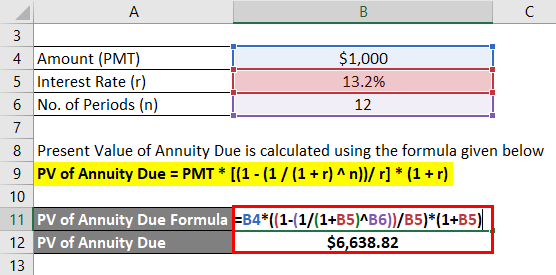

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Of An Annuity How To Calculate Examples

What Is An Annuity Table And How Do You Use One

Calculating Present Value Accountingcoach

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

What Is An Annuity Table And How Do You Use One

Present Value Of Annuity Calculator

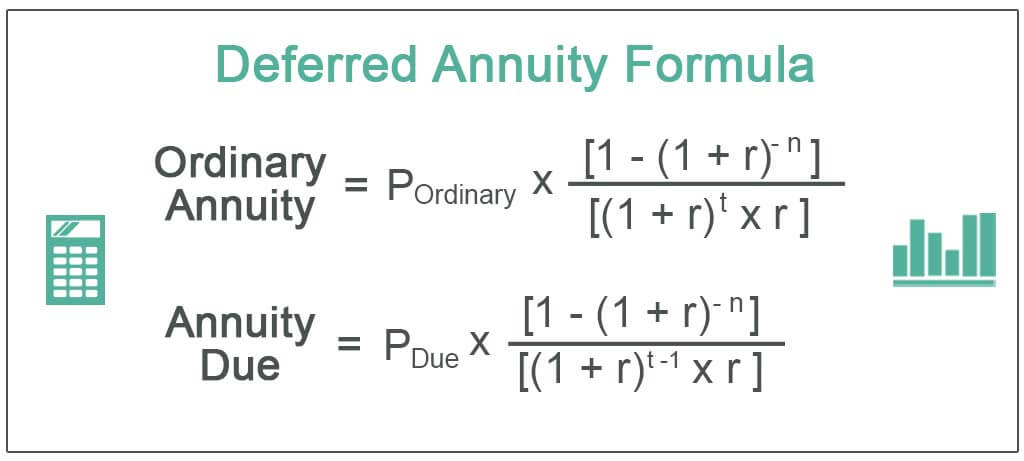

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

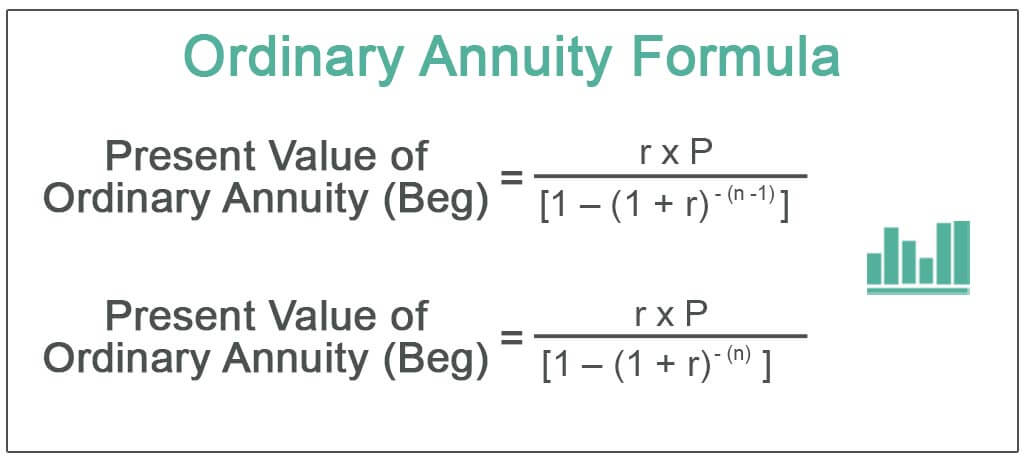

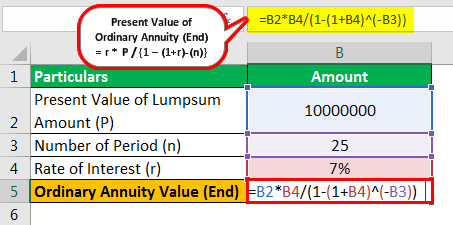

Ordinary Annuity Formula Step By Step Calculation

Ordinary Annuity Formula Step By Step Calculation

Present Value Of An Annuity Definition